Takeaways from Internet Retailing Expo – inc Feelunique, Laterooms, Eurostar, Bonmarche and much more (episode 048)

I’m really pleased to be bringing you our second Takeaways episode in a row (it’s been a busy month!!). After last week’s update from Catalyst, here is my update from the Internet Retailing Expo.

I spent Wednesday and Thursday at the NEC in Birmingham chairing sections of the conference. Luckily for all of you the 2 streams I got to chair were the 2 most interesting (although I suppose I would say that…) AND I got to ask lots of questions!

On Wednesday it was Insight and Experience – so all about focusing on the customer. On Thursday it was Digital Merchandising, which I think it one of the most fascinating areas of eCommerce right now. There are great takeaways from each to come.

Why not take a moment to add yourself to the early notification list for my new book – everyone who signs up before the publication date (16th May) will get a free copy. The new book is called Customer Manipulation: How to Influence your customers to buy more and why an ethical approach will always win.

Being totally honest my personal biggest takeaways from the expo was relief that my new book is 100% hitting the nail on the head of the problem everyone is trying to solve at the moment! And the pre-publication reviewers are loving it! Alex O’Byrne, Founding Director, We Make Websites, says:

“Chloë’s latest book is a triumph, it guides you through the journey of finding your audience and creating a strong customer base. What’s different about Chloë’s book is that it never loses focus on the customer perspective. It tells you how to make sure customers understand your proposition and is jammed full of useful examples that are easy to follow. I’d recommend it to anyone that wants to take their business to the next level.”

Subscribe on your Favourite Podcast App

The book isn’t out for another 2 weeks, so let’s get on with the content you can get your hands on right now – my takeaways from Internet Retailing Expo.

IRX is a two day, free conference run by the same team that brings us IRC in the autumn (from which I did a takeaways session last year). There are 2 sides to the event – IRX focused on the retail world, and EDX which is all about delivery.

It’s a huge show with a massive exhibition hall – if you didn’t make it this year, add it to the list for next year! Because it’s an event packed with the best suppliers in the business, and some fantastic sessions.

Plus there are great delegates, each time I stopped anywhere I was bumping into great eCommerce people – so much knowledge in those rooms and halls. Special thanks goes to all of you (the listeners) who came and introduced yourselves, too many to mention here – but thank you all, and I can’t wait to hear about how things are progressing for you).

here’s the list of what I’m just about to run through for you:

- General eCommerce picture / future thoughts – inc Ian Jindal, and Mat Braddy

- UX – User Experience

- Community learning to grow faster

- Case study from Bonmarche

- Case study from Feelunique

General eCommerce picture / future thoughts

Almost every session talked about the changing customer behaviours and expectations. So this part of the takeaways will bring you the key messages from across all the sessions.

Millennials / changing expectations

Mat Braddy founder of both Just Eat and Rock Pamper Scissors (as well as a future eCommerce MasterPlan Podcast guest…) summed up the feelings pretty well with this quote from Yves Behar the designer of the Jawbone:

For example Match.com has taken a massive dive in recent years, being superseded by Tinder. Why? Because Match.com were marketing commitment – fill in 20 forms, and you too could be one of x% of members who get married.

Where as Tinder is marketing fun and quick connections. And there’s very little you have to do to sign up.

Mat introduced us to an American app called “Push for Pizza” which has a promotional video which does a VERY good job of explaining both the product itself and why it’s been so successful with it’s target customers.

The changes in the industry

Ian Jindal (editor of Internet Retailing – the UK magazine) ran us through the “6 changes in the Experience Ecosystem that puts retailing into our customers hands” that are happening that mean we need to embrace what Internet Retailing have termed “Total Retail”. I’ve reduced them to 5 for this podcast…

1. Marketplaces

You need to have a marketplaces strategy. It’s a busy and changing space, with over 400 market places operating in the EU, and more of the UK’s buying journeys now starting on Amazon than Google. There’s a marketplace for everything now, so it’s important to work out how this affects your strategy – right from the top (eg What do we specialise in? product? Ops? Marketing? Etc) to working out which market place to be on.

One of my panellists was Glen from Fruugo – a really interesting marketplace that’s well worth checking out if you’re looking to go international.

2. New Store experiences

Hitting offline, but changing customer’s expectations throughout retail:

Waitrose (UK supermarket) now have a big branch in King’s cross which includes a Wine Bar AND a Cookery School.

John Lewis (UK department store) are rolling out “Smart Home Departments” to give customer the experience of the smart home technology – the aim being to educate the customer so they can buy the product.

In (an example from Sarah McVittie of Dressippi’s session) US Menswear retailer Bonobos last year opened a store on 5th Avenue in New York, which stocks one of each item in every size. Men visit the “Guideshop” try on everything they like, and place an order which is delivered to their home the following day – no annoying shopping to carry, and no returns to deal with. Clearly it’s working well for them as they now have 21 of these “Guideshops” all over the USA.

3. Post purchase experience becomes the ecosystem experience

Consumers have to live with their purchases – so how can that experience be improved? How do we need to think differently about that experience?

Eg the coffee machine, a consumer only buys a new one every 10 years. Yet they use it every day, buy coffee every week, and have to replace the filter every 2 years.

How can the retailer be involved in all these steps?

4. Mobile – the remote control for life

For example how many remotes do we need? How many product apps do we need? Should there be a separate app for each different product by the same manufacturer?

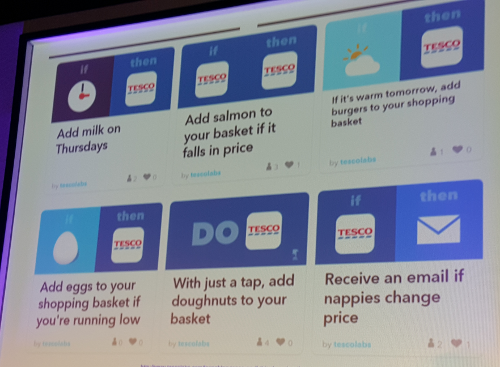

Tesco (another imminent guest on the eCommerce MasterPlan Podcast) are doing some really clever things with IFTTT. Very simple technology which can be used to automate the online grocery shopping basket.

5. The Zero Margin Post-retail world

I thought this was the most powerful of Ian’s changes. On traditional business models the final retail price is being pushed down by market places, customer expectations etc. Yet the customer’s desire for good service is going up, which costs money to deliver.

This is the driver to manufacturers increasingly wanting to get involved in the retail side of things (see last week’s takeaways from Catalyst for more on that).

How can you deliver the prices and service the customer wants?

Is there the opportunity to use those 2 drivers to deliver a better product – eg in insurance if you fit a black box to your car, by driving sensibly you can reduce your insurance premiums.

I’m aware there are few answers there, so see this bit as a lot of food for thought!

UX – User Experience

Right let’s get into some more practical advice…

SLI Systems site search tips

Ian Scarr of SLI Systems did a session sharing tips about how the various parts of the SLI Systems software can improve your conversion rates. Of course much of this is possible with other software systems. I think it’s a nice little optimisation checklist, so here goes:

You need to get your search working :MarketSherpa research shows that customers take 8 seconds to decide whether they’re going to buy from you or not. And 43% of them go straight to the search box to see if you have what they want.

- Reduce the path to the product – when a customer starts typing into the search box start showing them relevant results in the search dropdown – before they even click “search”

- Don’t show ‘nothing’ – if the search brings back no results, show the customer SOMETHING. A wordcloud of popular searches, your best sellers, or some alternatives based on the search.

- Understand your visitors – so look at what they’re searching for and use this to improve the experience. That might be getting new products in, or tweaking the search system so it takes into account synonyms and misspellings, or (as Jigsaw have done) directing someone searching for ‘maternity’ to a selection your products which would work for a pregnant lady even though you don’t do maternity wear.

- Make product recommendations – over 75% of the Amazon homepage is recommendations. They work.

Some really useful tips there – many of which you can start doing with just the Google Analytics site search tool. Which will help make the business case for investing in a proper search solution.

Tips from the travel world Eurostar and Laterooms

I saw 2 presentations which were heavily focused on how to do UX testing. Both from the travel sector. They were Neil Roberts the head of Digital at Eurostar and Imran Younis, Former global head of UK at Laterooms.com. Both were focused on a similar process, so here’s a compilation of tips from their sessions.

- Involve the customer from the start. Conduct surveys, do live testing sessions, get their opinion and don’t guess!

- Involve the customer throughout. One set of customer input isn’t enough, you need them to input at every stage.

- Use analytics to find out the what.

- Use customer feedback tools to find out the why. Try usertesting.com and whatusersdo.com

- Roll out your tests fast. The only way to truly see if it’s the right thing to do is put it live on the site. So the faster you get that change live, the faster you’ll see what else needs to be tweaked (and get the benefits of the improvements)

- Sometimes simple tweaks can make a big difference. Eurostar added a strip showing their USPs to the checkout and it increased conversion by 3.7%

- Prioritise your testing based on the potential impact of each test.

- Remember that the customer experiences your business across multiple devices – never focus only on one channel.

- You MUST get the whole business working together on UX improvements. That includes getting HR in on it all.

- Laterooms operate a “BYOD” day every Friday. “Bring Your Own Device” to work day means everyone in the business gets the opportunity to try out the service levels and experience on all kinds of devices. Gets everyone involved and provides lots of great insight.

Community learning to grow faster

This one came a surprise to me!

Two different suppliers were extolling the benefits of retailers sharing their data to help them grow their business. Now, in the UK mail order sector we’ve been using data co-operatives to help reactivate data and recruit new customers for decades. At IRX this year I learnt about 2 new ways to pool data…

Mysupermarket

On the front of it mysupermarket is a way for customers to build their weekly grocery shopping online, and as they build it find out how to save money by either shopping from a different supermarket OR picking a different product.

Behind the scenes it’s a lot more than that – in fact it’s the number 4 most visited retail site in the UK which means their visitors form the largest online shopper panel in Europe. Some of their visitors buy via them (because they are a marketplace), but most are researching, and of those researchers 65% chose to buy offline.

Product wise they cover everything you might buy in a supermarket, but they list products from 100s of retailers including many independents.

The really great bit about mysupermarket (and the bit which fits with my theme about community learning) is that manufacturers and the retailers are using the traffic on mysupermarket to run tests that can then be rolled out to their retailers, or direct onto the retail sites themselves. So mysupermarket is providing a platform where image options, descriptions, or even navigations etc can be tested before being rolled out to your own website.

dressipi

Dressipi is changing the online fashion experience. A customer signs up for the service via the retailers website. Fills in a questionnaire about themselves, their sizing, and their clothing preferences. Then they get a more tailored service on the website – which sizes they should be buying, the products which fit their preferences etc etc. So far 2.5 million women have completed the survey.

The customer’s profile is owned by the customer – so they can take it with them to other retailers who are using Dressippi. Given this includes some of the UK’s largest female fashion destinations it’s a great benefit to the customer.

It’s also powering impressive data and lessons because Dressipi are able to see a greater level of the customer’s buying habits. The example Sarah McVittie used (and which I’ll repeat now!) is that the average UK woman buys a new winter coat every 2 years, so if she’s on the M&S site and bought a coat from TopShop last week M&S should be showing her other items.

In each of these examples the act of giving the customer a better experience has led to data being captured that can massively improve the customer experience. I think this concept of pooled data may hold a key to greater business performance in the future – so keep an eye out for such opportunities in your niches.

I’m going to wrap up this podcast episode by taking you through the 2 retailer case studies I have for you.

Case studies from the retailers: Bonmarche

Paul Kendrick Multichannel Director of Bonmarche outlined “Single Customer View Demystified – Beyond the Technology, Do Customers behave in a consistent and measureable way?”

Bonmarche is a UK women’s clothing brand targeting the older generation, and with both stores and an online website.

His primary point was that achieving SCV is as much about mindset as it is about software. (similar theme to the UX items from earlier).

To help tie up data between offline and online they run a “Bonus Club”

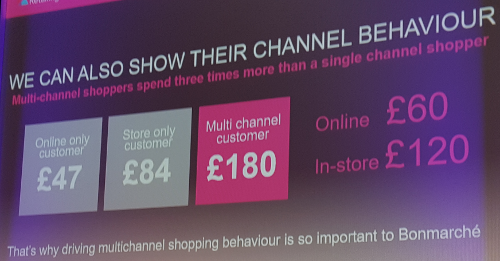

This has enabled them to prove why multichannel behaviour is essential:

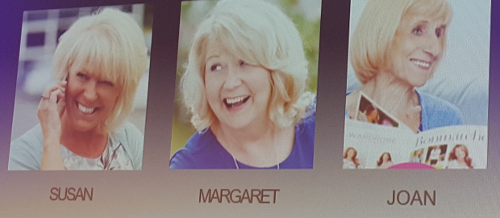

On top of this they have laid out 3 customer personas

These personas allow them to understand who different items in the range is appealing too – given they’re trying to attract a younger customer (other wise their business will literally die off) it’s not enough to have a best seller, they need a best seller within the youngest persona.

Mixing customer personas and loyalty stages gives them an easy way to manage the marketing activity. So the strategy stays the same, but the execution differs per persona.

Having a bricks element means that Bonmarche are used to dealing with imperfect data – only 70% of store sales include a Bonus Club Swipe – so they’re basing all this on just 70% data (plus the online stores). That is a big lesson for all of us – we don’t need everything captured to drive our strategy and growth.

Paul also pointed out that whilst mostly their customers behave in a consistent and measureable way we’re still looking at HUMANS, so there has to be a volume of data before you can see the trends (statistical significance).

He also reminded us that data is only part of the story – we don’t know if it’s cause or effect unless we have dialogue with the customer.

“I wish they didn’t turn on that seatbelt sign because every time they do it gets bumpy.”

Case studies from the retailers: Feelunique

It was a pleasure to meet Joel Palix CEO of Feelunique, and his session was a great insight into the complex world of beauty retailing.

Beauty is one of the hardest eCommerce sectors because it’s very hard to get the product. First you have to have an actual salon because most of the brands will only sell to salons. Then you have to build a strong relationship with the brands in order to get them to agree to sell on your site, after 10 years he thinks he might finally be at the point where brand acquisition can be replaced as the number one item on his to do list.

A bit of background, Feelunique have 1.5 million customers, turned over £80m in 2015 90% of which was online, and 70% of which is UK. 12,000 parcels ship per day from their one warehouse in Northampton – which is run by an outsourced partner. So, you can do £24 million overseas turnover and still despatch everything from the UK. And you can focus on customer service but still outsource your warehouse.

They have big ambitions:

All of which will be delivered by sticking to their DNA:

- Unique

- Powerful

- FUN

- Accessible

- Digital

- And brand mantra “Beauty without boundaries”

Marketing-wise they are focused on:

- Offline media to raise awareness

- Digital media to cause the sale and hook them in

- All with a consistent presentation (images and messages) because the customer finds that reassuring.

The site fulfils two needs, to help the customer find the item they want AND help them find products they didn’t know existing or wanted. The first is done via navigation and filters, the second via articles and content.

Key to selling beauty online is to reassure the customers that the product is real. Hence they ship from the uk, and have reviews on the homepage.

Samples are also very important. And are available to customers in 3 ways:

- They can order a full size item, and have the sample size delivered at the same time. They start using the sample, if they don’t like it – send back the full size

- Once they spend a certain amount free samples are available to them

- (Coming soon) pick n mix – order 5 testers each month, pay £3.95 P&P, which if you buy any of the 5 will be taken off the price

Customers can also subscribe for their favourite items.

(on a side note Joel sees the beauty discover box subscription services as doing a great service for the industry by encouraging more people to shop beauty)

Another example of a business listening to its customers, working out what’s stopping them from buying, and making it real easy for them to buy.

Bullet point takeaways

- You have to user test

- Don’t work in silos

- Consider marketplaces

- Where can you pool data across the industry to make your business better faster?

- Pay attention to site search

- Getting a start on SCV will take you ahead of most businesses, and it doesn’t have to be perfect

- Listen to your customers, and build what they want